Means for Black America

is the fourth topic in the Project 21 series:

“What It Means for Black America”

Project 21 is a division of the NATIONAL CENTER FOR PUBLIC POLICY RESEARCH, a non-profit, non-partisan educational foundation based in Washington, D.C.

PROJECT 21 • WHO WE ARE

Project 21 is an initiative of the National Center for Public Policy Research launched in 1992 to promote conservative and libertarian black leaders in the media so that news coverage better reflects the true diversity of thought within the black community.

Project 21 members have been interviewed over 50,000 times — currently averaging more than two television interviews each day — appearing on FNC, CNN, C-SPAN, MSNBC, NewsMax and OANN. In addition, Project 21 members are interviewed on radio an average of nearly 1.5 times per day and have appeared on major radio stations and shows such as the Rush Limbaugh Show, Sean Hannity and Jim Bohannon. Members are also frequently published and quoted in newspapers, including the New York Times, Wall Street Journal, Washington Post, Washington Times, Detroit News, Houston Chronicle and many others.

Project 21 members come from all walks of life and from all over the country. Its membership includes members of the clergy, business leaders, entertainers, athletes, economists, journalists, attorneys and students.

What Project 21 members have in common is a desire to make America a better place for black Americans — and all Americans — to live and work.

They do so not only by writing op-eds and participating in radio and TV interviews on the most important issues of the day, but also by advancing a positive vision for improving the lives of black Americans. Project 21 publishes the “Blueprint for a Better Deal,” a series of publications offering specific policy recommendations for helping black America reach its full potential. Notably these recommendations build on key aspects of Americanism — free enterprise, personal responsibility and limited government — and consequently would result in benefits for the country, not just blacks. It also publishes the “What it Means for Black America” series of monographs that assess policy initiatives for their specific impact on people of color.

Project 21 members also give speeches before student, community, business and religious groups; testify before Congress and other government bodies; advise policymakers at the national, state and local level and file public comments on federal rulemakings.

PROJECT 21 • LEADERSHIP

CO-CHAIRMEN

HORACE COOPER

In addition to co-chairing Project 21, Horace Cooper is a senior fellow and member of the board of directors of the National Center for Public Policy Research. He previously served as deputy director of Voice of America, chief of staff at the U.S. Department of Labor and was a senior aide to the leadership of the U.S. House of Representatives. He also taught constitutional law at George Mason University School of Law. He is the author of “How Trump is Making Black America Great Again.” He appears regularly on the Fox News Channel and talk radio shows across the nation as a legal and political commentator.

DONNA JACKSON

As Project 21’s Director of Membership Development, Donna is also a seasoned accountant with public and private sector experience as well as previous forays into politics and ministry. She earned a Bachelor of Accountancy (cum laude) from the California State University San Marcos, and has worked in accounting, auditing and management roles with major companies such as Ernst & Young and Marriott International before serving in the public sector as a deputy controller for the Export-Import Bank of the United States. Prior to her career in accounting, Donna was a political operative in the state of Arkansas, where she worked on campaigns for Governor Mike Huckabee, Senator Tim Hutchinson and Representative (now Governor) Asa Hutchinson. Donna is a regular op-ed contributor and frequent guest on Fox News Channel, Newsmax and OAN.

INFLATION:

A Scourge Wreaking Havoc on Black Communities

“I know families all across America are hurting because of inflation. I want every American to know that I am taking inflation very seriously.”

PRESIDENT JOE BIDEN, MAY 10, 2022 1

The re-emergence of high inflation — an affliction long thought to be confined to the era of VCRs, rotary phones and electric typewriters — has caught the America of 2022 woefully unprepared to deal with its myriad challenges.

Though the cost of living is rising globally thanks to such things as supply-chain bottlenecks, ill-advised reliance on renewable energy in many countries and grain shortages brought on by the Russian invasion of Ukraine, skyrocketing inflation in the United States has its own unique causes and effects.

A survey released on May 12, 2022 by Pew Research found that, by a wide margin, Americans view inflation as the top problem facing the country today. Seven-in-ten Americans believe inflation is a very big problem, followed by affordability of health care (55 percent) and violent crime (54 percent), PEW reported.2 With prices rising at their fastest clip in 40 years, and with few signs of relief in the offing, the plague of inflation seems likely to continue to spread, ultimately affecting far more people than the pandemic of recent memory.

Though viewed with alarm across the nation’s income spectrum, rising inflation places a disproportionate burden on lower-income households — especially the soaring costs of food, housing and energy — Federal Reserve governor Lael Brainard noted in a speech in early April. Lower-income households spend 77 percent of their income on necessities — more than double the 31 percent of income spent by higher-income households on these categories, she added, according to the Washington Post. 3

Data contained in the Bureau of Labor Statistics’ Consumer Price Index (CPI) showed prices for all items covered in the CPI surged 8.6 percent in the 12 months ending in May. “The energy index rose 34.6 percent over the last year, the largest 12-month increase since the period ending December 2005. The food index increased 10.1 percent for the 12 months ending May, the first increase of 10 percent or more since the period ending March 1981,” the Bureau of Labor Statistics said. 4

A Hidden Tax

“The main point that I can’t stress enough is that inflation is a hidden tax,” E.J. Antoni, a research fellow at the Heritage Foundation’s Center for Data Analysis, recently told the Daily Caller News Foundation. “It robs people of their purchasing power, transferring it to the federal government. This is how the Biden Administration is paying for trillions of dollars of unfunded government expenses.” 5

“The average worker has lost the equivalent of about $2,600 in annual income since Biden took office through inflation,” he continued. 6

Paul Kupiec, resident scholar at the American Enterprise Institute, also sees inflation as a hidden tax that redistributes wealth to the federal government.

“Inflation is a real tax, just as real and at times nearly as important as the income tax,” he wrote in The Hill in November 2021. “While inflation clearly does reduce the purchasing power of your earnings and fixed-income asset values, it also redistributes purchasing power from businesses and households to the federal government.” 7

Now that inflation has again raised its ugly head, a glaring omission by the federal government’s data-collection agencies stands in the way of assessing the effect of rising prices on the nation’s diverse racial and ethnic communities: Statistical agencies do not break out inflation by demographic groups.

Having on average less money to spend on life’s necessities, black Americans find themselves, through inflation, increasingly transferring what wealth they have to a federal government whose policies are at the root of the devalued currency that undermines their livelihoods.

“The main point that I can’t stress enough is that inflation is a hidden tax,” E.J. Antoni, a research fellow at the Heritage Foundation’s Center for Data Analysis, recently told the Daily Caller News Foundation. “It robs people of their purchasing power, transferring it to the federal government. This is how the Biden Administration is paying for trillions of dollars of unfunded government expenses.” 5

“The average worker has lost the equivalent of about $2,600 in annual income since Biden took office through inflation,” he continued. 6

Paul Kupiec, resident scholar at the American Enterprise Institute, also sees inflation as a hidden tax that redistributes wealth to the federal government.

“Inflation is a real tax, just as real and at times nearly as important as the income tax,” he wrote in The Hill in November 2021. “While inflation clearly does reduce the purchasing power of your earnings and fixed-income asset values, it also redistributes purchasing power from businesses and households to the federal government.” 7

Now that inflation has again raised its ugly head, a glaring omission by the federal government’s data-collection agencies stands in the way of assessing the effect of rising prices on the nation’s diverse racial and ethnic communities: Statistical agencies do not break out inflation by demographic groups.

“Aggregate statistics — they’re critically important for us, but they don’t really tell a very full story about how individual communities are experiencing employment and inflation” the Fed’s Brainard acknowledged. 8

Despite the lack of demographic-specific data on the effects of inflation, the “full story” can be pieced together from available sources, taking special note of trends driving the current surge in the cost of living.

The wealthy, irrespective of race or ethnicity, may be annoyed by inflation, but higher prices pose no real threat to their livelihoods. That picture changes dramatically, however, at the lower rungs of the income ladder. And because black Americans are disproportionately represented in lower-income brackets, its stands to reason that they bear the heaviest burden of inflation. The highest median household income in the U.S. in 2020 was among Asians at $94,903. For non-Hispanic whites, the comparable figure was $74,912, Hispanics (of any race) $55,321 and blacks $45,870, according to Statista.com. 9

Having on average less money to spend on life’s necessities, black Americans find themselves, through inflation, increasingly transferring what wealth they have to a federal government whose policies are at the root of the devalued currency that undermines their livelihoods.

HOUSING

Homeownership is a major component of individual wealth in the U.S., and racial disparities in homeownership therefore play a decisive role in determining how wealth is distributed across demographic groups. In 2019, the homeownership rate among white, non-Hispanic Americans was 73.3 percent, compared with 57.7 percent among Asian and Pacific Islander Americans, 57.5 percent among Hispanics and 42.1 percent among blacks, according to usafacts.org. 10

While low levels of black homeownership predate today’s rampant inflation, the distortions in the current housing market, including a shortage of homes for sale and higher mortgage interest rates, threaten to impede black families’ prospects of becoming first-time homeowners.

Record-high home prices and record-low inventory of homes for sale have pushed many would-be home buyers to the sidelines. Thanks to the FED’s belated recognition of the seriousness of the inflationary spiral, mortgage rates are rising at their fastest pace in 35 years, making home purchases much more expensive than just a few months ago. The rate for a standard 30-year fixed-rate mortgage crossed the 5-percent mark in April for the first time since 2011. As recently as early January, the average rate was 3.45 percent, according to mortgage-finance giant Freddie Mac. 11

Coinciding with the higher expense of purchasing a home, renters are also facing skyrocketing prices amid a shortage of apartments. Rents were up nearly 11 percent in late 2021, but for-sale home prices rose even faster at nearly 19 percent, according to the Harvard Joint Center for Housing Studies. 12

“The U.S. has a serious shortage of housing across all price points.”

“The U.S. has a serious shortage of housing across all price points,” the National Multifamily Housing Coalition (NMHC) noted on its website. “That shortage is the result of decades of failed housing policy at all levels of government. And it was exacerbated by the housing bust that followed the Great Recession of 2008 when new apartment construction plummeted.” 13

NMHC estimates that the U.S. will need to build an average of 328,000 new apartments every year by 2030 to meet expected future demand. But today’s rising inflation poses a significant barrier to reaching that goal. “The supply shortage is further exacerbated by rapidly rising for-sale housing prices that are preventing would-be first-time house buyers from moving out of apartments,” the organization pointed out. 14

“Overall rent prices are growing faster than incomes, leading to affordability issue for renters across the country.”

The low level of black homeownership means that black Americans are disproportionately represented among renters. And renters are feeling the pinch of inflation. Rents have gone up 17 percent nationwide year-over-year, with February marking the seventh consecutive month of double-digit price growth for studio to two-bedroom apartments, according to a March 2022 report from Realtor.com. 15

The median rent for an apartment reached $1,792 in the 50 largest U.S. metro areas — increasing four times as fast as pre-pandemic rent prices, according to the report. “Overall rent prices are growing faster than incomes, leading to affordability issue for renters across the country,” CNET reported. 16

ENERGY AND TRANSPORTATION

It has often been said that energy is the lifeblood of the economy. Though electricity is taken for granted by most Americans, people are now having to pay considerably more for it — a trend that is likely to continue. According to the Energy Information Administration (EIA), the average retail residential electricity price increased by 4.3 percent in 2021 to 13.74 cents per kilowatt hour (kWh), the fastest climb since 2008. 17

“We forecast that residential retail electricity prices will continue to rise in 2022, although at a slightly slower rate,” EIA researchers said. “In 2022, we expect the average nominal price to increase by 3.9 percent to 14.26 cents/kWh.” 18

EIA attributes this price rise to a natural gas crunch that has made it more expensive for utilities to produce or buy electricity. Those costs are passed on to consumers. The cost of natural gas delivered to power plants averaged $4.98 per million British thermal unit (Btu), more than double the cost in 2020, Yahoo Finance pointed out. 19

There may be a natural gas crunch, as EIA suggests, but there is no shortage of this valuable energy source in the U.S. The United States has vast reserves of natural gas, and is the world’s largest gas producer far outstripping second- and third-place finishers Russia and Iran. 20 Since coming into office in January 2021, however, the Biden Administration — as part of its climate agenda — has discouraged domestic natural gas (and oil) development and proposed policies designed to thwart construction of gas pipelines. It makes little sense to go to the considerable expense of extracting natural gas if it lacks the infrastructure to be transported to consumers.

The predictable result is a government-made shortage that drives up electricity prices. Those who can least afford to pay the higher prices are people with lower incomes, of whom black Americans comprise a disproportionate number.

The predictable result is a government-made shortage that drives up electricity prices. Those who can least afford to pay the higher prices are people with lower incomes, of whom black Americans comprise a disproportionate number.

The same holds true for the rising cost of transportation fuel. AAA says the national average for a gallon of gas at the pump was over $5.02 a gallon in mid-June of 2022, an all-time high. 21 Diesel, the workhorse fuel in manufacturing, agriculture and heavy transport, powers the nation’s trucks, tractors and construction equipment. It, too, is in short supply, and AAA reports diesel reached its highest recorded average price of $5.82 a gallon in mid-June. 22 Higher diesel prices are passed on to consumers at the supermarket, where they eat into the already marginal disposable incomes of tight-budgeted shoppers. What’s more, other segments of the transportation sector — including air travel, trains and busses — are also having to cope with rising fuel prices and will have to pass those costs on to consumers.

After initially blaming higher prices at the pump on Russian President Vladimir Putin, the Biden Administration offered another explanation. During a May 24 press conference in Tokyo, Biden said rising fuel costs were part of an “incredible transition” away from fossil fuels. 23 There is no doubt that a transition is being forced upon Americans, leading to shrinking disposable incomes throughout the country in the process.

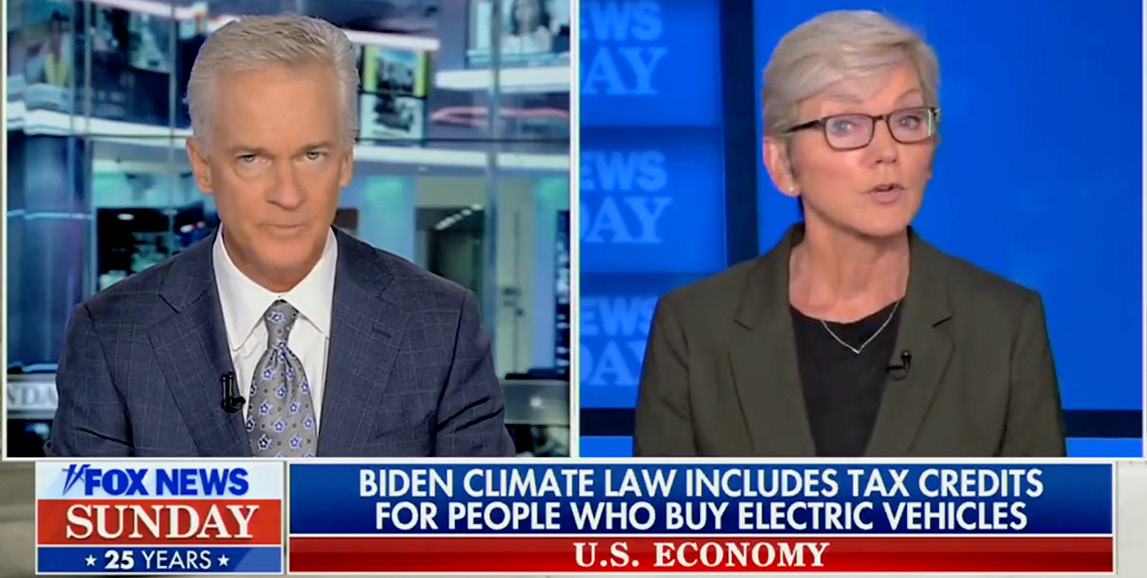

While families are struggling with 40-year high inflation and making ends meet, Biden Energy Secretary Jennifer Granholm suggested, “[i]f you are low income, you can get your home entirely weatherized.” Granholm went on to add, “if you are moderate income, today you can get 30% off the price of solar panels.” It is unclear how the Biden Administration expects families to make these investments, or how they will help with ever increasing energy costs at a time when they are having trouble fueling their vehicles and putting food on the table. As is the case in all items affected by spiking inflation, black Americans stand to be the biggest losers in a world of higher transportation costs.

Out of touch with how anyone but the elite live, the Biden Administration claims tax credits in their new legislation will help “working famillies” battle inflation if they would simply just buy expensive electric cars and upgrade their home to incorporate solar panels.

And, that’s just the cost of fuel. For people in the market to buy a vehicle, new or used, the outlook is just as grim. Statistics report that new vehicle prices were up 12.6 percent over last year in May 2022. 24 Prices for the materials that go into a new car, SUV or pickup have all gone up, and supply-chain bottlenecks have made some vehicles hard to get. Those seeking relief in the used-car market are in for a disappointment. Used-car prices rose 45 percent during the pandemic, reaching an average price of $29,969 at the end of 2021. Prices began to moderate somewhat in the spring, because buyers were no longer willing to pay what dealers wanted, according to data from automotive research firm Edmunds. 25

Inflation is nothing if not regressive. Even black Americans firmly anchored in the middle class are finding it difficult to procure a vehicle — used or brand-new — in today’s inflationary environment.

For its part, the Biden Administration is going to extraordinary lengths to ensure that Americans are denied access to affordable domestic energy. In mid-May, the Interior Department confirmed it would not sell three oil and natural gas leases in the Gulf of Mexico and off the coast of Alaska that had been scheduled. 26 The move takes millions of acres off the auction block and comes amid the White House’s alleged concern over families having to cope with rising energy prices.

While it’s true that the oil and gas from the lease sales would not be available for several years, the Biden White House signaled it has no real interest in securing these resources for the benefit of families and businesses in dire need of relief from the rising cost of living.

FOOD

Of life’s necessities, food is right at the top. Since inflation started to grip the U.S. in 2021, visits to the grocery store have become more expensive. Food inflation saw its largest annual increase since March 1981, rising at 8.8 percent year over year — with a recent Bank of America analysis forecasting that U.S. food inflation will hit nine percent by the end of the year. 27

Staples like bread, milk, meat, fruit and vegetables have been caught up in the inflationary spiral, with Bank of America analysts expecting “sustained price increases later this year.” 28

Farmers are having to cope with the rising cost of fertilizers and pesticides, which has risen almost 50 percent since the spring of 2021. Fertilizer prices have also been affected by the higher cost for natural gas, which is critical to the production of nitrogen-based fertilizers. Fertilizers and chemicals represent 10 percent to 20 percent of total cost for U.S. farmers, Bank of America said. 29

Various factors, including an acute shortage of truck drivers, have pushed up the CPI for gasoline and fuel-oil index by 48.7 and 106.7 percent, respectively, year-over-year. 30 And the resulting rising costs to consumers can be seen in supermarkets all across the country. There are no indications that relief from higher food prices are on the horizon — a daunting prospect for lower-income people whose disposable incomes diminish with each passing day.

Though the origins of 2022 baby formula shortage lie outside the world of inflation, the empworld empty shelves in supermarkets that continue to infuriate parents with hungry infants have been most devastating in black communities. First to the origins: The crisis was triggered by the failure of the Food and Drug Administration (FDA) to react in a timely fashion to a whistleblower complaint last October about possible contamination at an Abbott Laboratories manufacturing facility in Michigan that makes over 40 percent of the baby formula used nationwide. 31

The 2022 baby formula shortage hit hard for many black families. Citing data from the Centers for Disease Control and Prevention, The Washington Post reported black infants are less likely to be breastfed than white, Hispanic and Asian babies.

Compounding its error, the FDA ordered a shutdown of the facility in February without securing adequate supplies of formula to cover the loss in production. The resulting shortage hit low-income communities hard because of the outsized role played there by the federal food assistance program known as WIC (Women, Infants and Children). Over 1.7 million infants are in the WIC program, which provides baby formula to needy mothers, much of which comes from Abbott. Black infants are less likely to be breastfed than white, Hispanic and Asian babies, the Washington Post reported, citing data from the Centers for Disease Control and Prevention (CDC). Infants who receive WIC assistance are also less likely to be breastfed than babies who are not eligible for the program, raising the vulnerability of the former to shortages of baby formula. 32

The FDA’s incompetence created an acute food shortage among infants at a time when many families were already struggling to keep up with higher prices for many essentials of life. Black Americans already caught up in the inflationary spiral bear the brunt of this government-imposed food shortage.

CLOTHING

“Inflation is Coming to Your Closet” was the catchy, and accurate, headline of a recent Fortune article on rising prices for what we wear. The State of Fashion 2022 report by the Business of Fashion and McKinsey & Co. found a worrying 15 percent of executives surveyed said they planned on increasing prices more than 10 percent in 2022. 33 Release of the survey predated the Russian invasion of Ukraine and China’s massive lockdowns designed to reach zero COVID infections in the world’s most populous country. Both developments have contributed to rising energy prices and snarled supply chains, threatening to drive up the prices for everything from hats, shirts, skirts, pants, coats, underwear and shoes.

Overall, the Bureau of Labor Statistics’ CPI showed prices for apparel rising 5.4 percent year over year. 34 While this is lower than the current 8.3 inflation rate, clothes are essential to everyone. For families with limited means, budgeting for new clothes — even in the local thrift shop — increasingly involves making hard choices. Salaries and hourly wages, though rising, are not keeping up with inflation.

The goal of many black Americans to escape the curse of poverty and dependence on government “assistance,” is being thwarted by the rising cost of living. Moving to a better — and safer — part of town, maintaining a healthy diet, heating our homes, even feeding our babies — all are being pushed beyond the reach of more and more black families.

What We Believe

About Inflation

Far from being the “transitory” phenomenon the Biden Administration claimed it was, inflation has ravaged the country for a year-and-a-half and shows no signs of letting up. Washington flooded the economy with trillions of dollars borrowed at near-zero interest rates. Congress was complicit in this exercise — gleefully signing off on, and adding to, the Administration’s requests to saturate the economy with dollars in the name of helping people recover from the pandemic. Before long, the size of the money supply far exceeded the pool of available goods and services. Warnings that this reckless behavior would spark inflation went unheeded. The Federal Reserve saw no need to slam on the brakes until the genie was well out of the bottle. And when the Fed finally acted by starting to raise interest rates, it was too late.

The rise in the cost of capital stifles business activity in every segment of the economy, with the U.S. now falling into recession. Stagflation — slow or negative economic growth, coupled with rising inflation — has returned.

Even allowing for the profligate spending that overstimulated the economy, there were steps that could have been taken to lessen the burden on ordinary working people. Instead, the Biden Administration deliberately drove up prices for energy and, through a combination of regulatory zealotry and bureaucratic ineptitude, made a bad situation worse.

Unimaginable just a few years ago, America is entering an age of scarcity. “Before the pandemic, the share of items unavailable on shelves was typically about five percent. Most customers barely noticed,” columnist Heather Long recently pointed out. “Lately, it’s been closer to 12 to 15 percent, sometimes worse.” 35 And the scarcity is not just on the store shelves. It is in energy, housing, apparel, automobiles, semiconductors, household appliances, building materials and countless other items. Worse, what is available is becoming so expensive that it is becoming out of reach for many consumers.

Today’s rampant inflation gives new meaning to the term “food deserts.” Food deserts are geographical areas where residents have few, if any, options to purchase affordable and nutritional food — especially fresh fruits and vegetables. Common in high-poverty areas (both urban and rural), food deserts are characterized by a high percentage of abandoned or vacant homes, high crime rates and the absence of economic opportunities that provide a path for social mobility. 36 According to a 2014 study by Johns Hopkins University, food deserts are disproportionately found in black communities.

That study compared census tracts of similar poverty levels and found that, in urban areas, black communities had the fewest supermarkets while white communities had the most. Multiracial communities fell in the middle of the spectrum. 37

Much higher prices, along with out-and-out scarcity, have now engulfed the nation’s food supply, making access to nutritional food a growing challenge, especially to lower-income black Americans. Food deserts are nothing new; in one form or another, they have been with us for decades.

What is new is that contemporary food deserts are rooted in ill-conceived policies that gave rise to today’s inflation. And the concept of a desert has moved well beyond food to include energy, clothing, housing and other necessities of life.

Indeed, grid operators are warning of widespread blackouts resulting from the closure of coal plants and nuclear power facilities and a growing dependency on intermittent renewable energy. 38 This is the “incredible transition” Biden boasted about in early 2022. But it is a transition to scarcity that will leave the most vulnerable behind.

The current situation is untenable and, if left unchecked, will further undermine the nation’s already fragile social cohesion. Reversing course is imperative. Project 21 recommends that, at the very least, the following steps be taken immediately:

- Unleash America’s vast energy potential by encouraging — not discouraging — the development and distribution of fossil fuels, thereby re-establishing American energy independence and driving down costs for consumers

- Adopt sound monetary policy by abandoning printing dollars as a means of financing government interference into every aspect of economic life, and exercise long-overdue fiscal restraint that will curtail shoveling hard-earned taxpayer dollars into the hands of well-connected special interests at the expense of ordinary families

- Cease the war on single-family housing, assiduously carried out by local and federal urban planners — thereby promoting personal choice in the market for homes and expanding the existing housing stock

- Reform the moribund WIC program to allow more competition in the production of baby formula to ensure that the crisis of 2022 will never be repeated

- Lift arbitrary land-use restrictions and other regulatory burdens that suppress the production of agricultural goods, lumber, precious metals and other commodities essential for life.

Project 21 members do not believe that the Biden Administration will undertake any of these steps. The White House, closely aligned with the interests of the ruling political class, has repeatedly shown that it cares little about improving the opportunities of those who must subsist far from the halls of power. Nevertheless, it is imperative that an alternative vision be put forward.

The future of black Americans — indeed, the future of all Americans — lies in partaking of the nation’s rich bounty. As a people, we are used to abundance — not shortages. There was nothing inevitable about today’s inflation; it is the product of misguided policies imposed by an out-of-touch elite completely oblivious to the harm they are inflicting on those least able to bear it.

For a complete list of participants in Project 21, click here.

REFERENCES

1 “Remarks by President Biden on the Economy,” The White House, May 10, 2022, https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/05/10/remarks-by-president-biden-on-the-economy-5/

2 Carroll Doherty and Vianney Gomez, “By a Wide Margin, Americans View Inflation as the Top Problem Facing the Country Today,” Pew Research Center, May 12, 2022, https://www.pewresearch.org/fact-tank/2022/05/12/by-a-wide-margin-americans-view-inflation-as-the-top-problem-facing-the-country-today/

3 Rachel Siegel, “Fed Official: Inflation Falls Hardest on Poor Families,” The Washington Post, April 5, 2022, https://www.washingtonpost.com/us-policy/2022/04/05/fed-inflation-poor/

4 “Consumer Price Index – May 2022,” Department of Labor Bureau of Labor Statistics, https://www.bls.gov/news.release/pdf/cpi.pdf

5 Thomas Catteacci, “Hidden Tax: Inflation Runs Rampant After Biden Skirts Blame on Rising Costs,” Daily Caller News Foundation, May 11, 2022, https://dailycaller.com/2022/05/11/inflation-consumer-price-index-labor-department-joe-biden/

6 Ibid.

7 Paul Kupiec, “The Inflation Tax is not only Real, It’s Massive,” The Hill, November 4, 2021, https://thehill.com/opinion/finance/580043-the-inflation-tax-is-not-only-real-its-massive/

8 Op. Cit. Siegel

9 “Median Household Income in the United States by Race or Ethnic Group,” statista.com, https://www.statista.com/statistics/233324/median-household-income-in-the-united-states-by-race-or-ethnic-group/

10 “Homeownership Rates Show That Black Americans Are Currently the Least Likely to Own Homes,” usafacts.org, July 28, 2020, https://usafacts.org/articles/homeownership-rates-by-race/

11 “30-Year Fixed-Rate Mortgage Since 1971,” freddiemac.com, https://www.freddiemac.com/pmms/pmms30

12 “America’s Rental Housing 2022,” Joint Center for Housing Studies of Harvard University, https://www.jchs.harvard.edu/americas-rental-housing-2022

13 “Talking Points: Rising Rents,” National Multifamily Housing Council, https://www.nmhc.org/globalassets/communications/resources/rising-rent-talking-points-2022-03.pdf

14 Ibid.

15 “February Rental Report: Sunbelt Metros See Highest Rent Growth and Low Affordability,” realtor.com, March 23, 2022, https://www.realtor.com/research/february-2022-rent/

16 Alix Langone, “Rent Increases by Nearly 20% Across the U.S.: What Renters Need to Know,” cnet.com, March 31, 2022, https://www.cnet.com/personal-finance/mortgages/rent-increases-by-nearly-20-across-the-us-what-renters-need-to-know/

17 “During 2021, U.S. Retail Electricity Prices Rose at the Fastest Rate since 2008,” United States Energy Information Administration, https://www.eia.gov/todayinenergy/detail.php?id=51438

18 Ibid.

19 Karina Mitchell, “Why Electricity Bills Keep Rising,” yahoofinance.com, March 17, 2022, https://finance.yahoo.com/news/why-us-electric-bills-keep-rising-113414648.html

20 “Natural Gas Production by Country,” worldometers.info,https://www.worldometers.info/gas/gas-production-by-country/

21 “Gas Prices,” aaa.com, https://gasprices.aaa.com/

22 Ibid.

23 Jake Thomas, “Backlash as Biden Says High Gas Prices Are Part of ‘Incredible Transition,’” newsweek.com, May 24, 2022, https://www.newsweek.com/backlash-biden-says-high-gas-prices-are-part-incredible-transition-1709401

24 Op. Cit Bureau of Labor Statistics

25 “$29,000 for a Used Car? Blame Inflation,” CBS News, January 4, 2022, https://www.cbsnews.com/news/used-car-prices-inflation-29k-average-edmunds/

26 Mathew Daly, “Biden Cancels Offshore Lease Sales for Gulf Coast, Alaska,” newsobserver.com, May 13, 2022, https://apnews.com/article/climate-environment-alaska-gulf-of-mexico-191a0e2be4a95f703d9f52a6b5c36895

27 Will Daniel, “Don’t Expect the Huge Rise in Food Prices to Slow Anytime Soon, Bank of America Report Says,” fortune.com, April 21, 2022, https://fortune.com/2022/04/21/inflation-food-rise-2022-bank-of-america-says/

28 Ibid.

29 Ibid.

30 Op. Cit Bureau of Labor Statistics.

31 Ryan Young, “Viewpoint 2: Cronyism Makes the baby Formula Shortage Worse,” The Finger Lakes Times, May 19, 2022, https://triblive.com/opinion/viewpoint-2-cronyism-makes-baby-formula-shortage-worse/

32 Frances Stead Sellers, “Formula Shortage is Worse for Low-Income Families, High-Risk Infants,” The Washington Post, May 18, 2022 https://www.washingtonpost.com/health/2022/05/18/baby-formula-shortage-impact/

33 Sophie Mellor, “Inflation is Coming to Your Closet, the Cost of Clothing to Jump Next year, New Report Says,” fortune.com, December 2, 2022 https://fortune.com/2021/12/02/inflation-clothing-metaverse-closed-loop-recycling-state-fashion-of-2022/

34 Op. Cit. Bureau of Labor Statistics.

35 Heather Long, “Americans are Stuck in an Age of Scarcity,” The Washington Post, May 8, 2022, https://qoshe.com/washington-post/heather-long/americans-are-stuck-in-an-age-of-scarcity-and-they-don-t-like-it/137649834

36 “Food Deserts in the United States,” Annie E. Casey Foundation, February 13, 2021, https://www.aecf.org/blog/exploring-americas-food-deserts

37 Kelly M. Bauer, Roland J. Thorpe, Charles Rhode, and Darren J. Gaskin, “The Intersection of Neighborhood Racial Segregation, Poverty, and Urbanicity and its Impact on Food Store Availability.” NIH National Library of Medicine, 2014, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3970577/

38 Kristin Altus, “Electric Grid Operators Warn of Potential Summer Blackouts,” foxbusiness.com, May 19, 2022, https://www.foxbusiness.com/energy/electric-grid-operators-warn-of-potential-summer-blackouts